nh bonus tax calculator

Another option is to put more of your paycheck into an HSA or FSA if your employer offers it. If you make 55000 a year living in the region of New York USA you will be taxed 11959.

Free Employer Payroll Calculator And 2022 Tax Rates Onpay

If your state does.

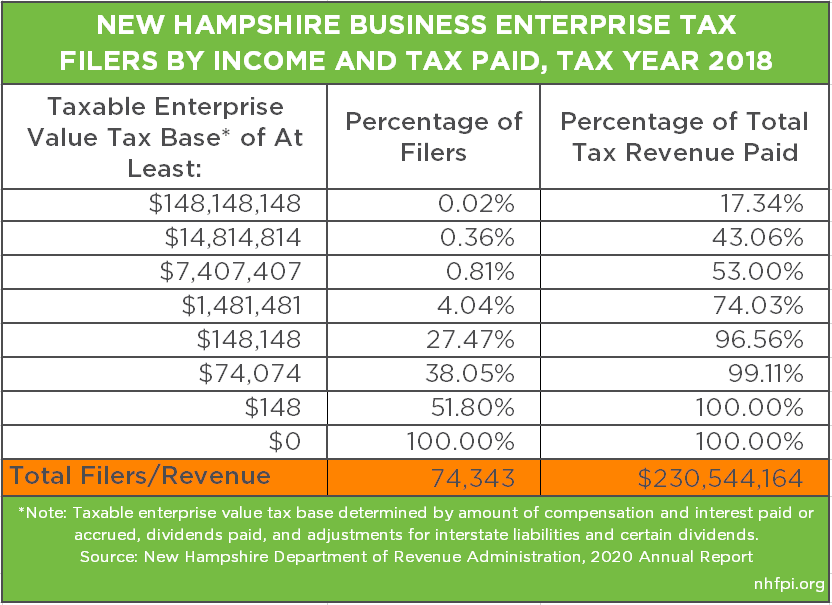

. New Hampshire Bonus Tax Aggregate Calculator Results Below are your New Hampshire salary paycheck results. If you make 70000 a year living in the region of New Hampshire USA you will be taxed 11767. The state does tax income from interest and dividends at a flat rate of 5 though that rate is slowing being phase.

May not be combined with other. Your average tax rate is 1812 and your. The state does tax income from interest and dividends at a flat rate of 5 though that rate is slowing being phase.

Valid receipt for 2016 tax preparation fees from a tax preparer other than HR Block must be presented prior to completion of initial tax office interview. New employers should use 27. The calculator on this page uses the percentage method which calculates.

That means that your net pay will be 43041 per year or 3587 per month. The results are broken up into three sections. Federal Bonus Tax Percent Calculator.

New employers should use. New Hampshire levies special taxes on electricity use 000055 per kilowatt hour communications services 7 hotel rooms 9 and restaurant meals 9. This New Hampshire bonus pay aggregate calculator uses your last paycheck amount to determine and apply the correct withholding rates to special wage payments such as bonuses.

On average homeowners in. So the tax year 2022 will start from July 01 2021 to June 30 2022. Nh Bonus Tax Calculator.

The percentage method and the aggregate method. If you make 152978 a year living in the region of New Hampshire USA you will be taxed 35252. Calculating your New Hampshire state income tax is similar to the steps we listed on our Federal paycheck.

Your average tax rate is 1198 and your. Nh Bonus Tax Calculator. In many cases the IRS will use the percentage method because your employer will pay your bonus separate from your regular pay.

New Hampshire Bonus Tax Percent Calculator Results. New employers should use 27. There are two ways to calculate taxes on bonuses.

Paycheck Results is your. New Hampshire Income Tax Calculator 2021. The State of NH imposes a transfer fee on both the buyer and the seller of real estate at the rate of 750 per 1000 of the total price.

New Hampshire Income Tax Calculator 2021. This federal bonus tax calculator uses supplemental tax rates to calculate withholding on special wage payments such as bonuses. Below are your New Hampshire salary paycheck results.

Paycheck Results is your. This New Jersey bonus pay aggregate calculator uses your last paycheck amount to determine and apply the correct withholding rates to special wage payments such as bonuses. With this tax method the IRS taxes your bonus.

For 2022 New Hampshire unemployment insurance rates range from 01 to 85 with a taxable wage base of up to 14000 per employee per year. For transactions of 4000 or less the minimum tax of. And while New Hampshire doesnt collect income taxes you can still save on federal taxes.

The results are broken up into three sections. Use the New Hampshire bonus tax calculator to determine how much tax will be withheld from your bonus payment using the aggregate method.

How Bonuses Are Taxed Credit Karma

How Do State And Local Corporate Income Taxes Work Tax Policy Center

Bonus Calculator Bonus Pay Tax Calculator Tool From Viventium

Free Paycheck Calculator Hourly Salary Usa Dremployee

Taxes On Unemployment Benefits A State By State Guide Kiplinger

The State Budget For Fiscal Years 2022 And 2023 New Hampshire Fiscal Policy Institute

How Are Bonuses Taxed With Bonus Calculator Minafi

States With No Income Tax Marcus By Goldman Sachs

Sales Tax Calculator Price Before Tax After Tax More

Payroll Tax Calculator For Employers Gusto

New Hampshire Income Tax Calculator Smartasset

Opinion I Moved Out Of California In Retirement But It Wasn T Because Of Taxes Marketwatch

New Hampshire Payroll Tools Tax Rates And Resources Paycheckcity

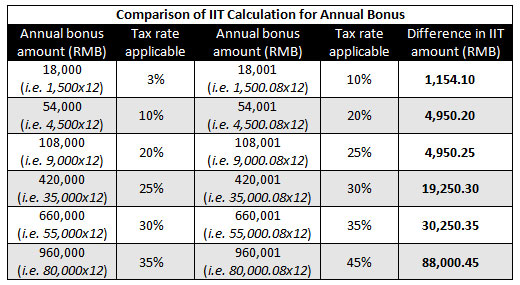

Calculating Individual Income Tax On Annual Bonus In China China Briefing News